客观的大温房地产数据,新闻,与评论 - Where you find objective, non-biased Vancouver real estate news, statistics, and analysis.

Wednesday 26 December 2012

U.S. retailers record worst holiday season since 2008

- we stole their Black Friday idea, only fair they borrow our Boxing Day..

U.S. retailers record worst holiday season since 2008

Dec 26, 2012

“The 2012 holiday season may have been the worst for retailers since the financial crisis, with sales growth far below expectations, forcing many to offer massive post-Christmas discounts in hopes of shedding excess inventory.”

At close: Retailers pull stocks lower on poor holiday sales

Friday 21 December 2012

End-of-the-world Greater Van Sales Stats

Dec 1-21

2012 vs 2011

Sales: 953 vs 1328 (-28%)

vs Nov: 953 vs 1241 (-23%)

Lists: 1215 vs 1375 (-12%)

Ratio: 78% vs 97%

Est Dec Sales: 1110 vs 1658 (-33% YoY, -34% MoM)

Est Dec Lists: 1380 vs 1629 (-15% YoY)

Est Dec Inventory: 13400 vs 12000 (+12% YoY)

Months of Inventory:11.5-12.5 months vs 7.2月 (vs Dec/11)

Greater Vancouver MOI is expected to reach ~12 months by month-end, worse than the 9.3 months of inventory in November 2012. We're heading deeper into Buyer's Market territory.

December sales and Sales/New-Lists Ratio will again be 2nd lowest in the last 10+ years.

REBGV HPI price is expected to fall again this month.

大温地区滞销量在12月底将达到12个月,比上个月(9.3个月) 滞销加剧, 更加深入买方市场

今年12月成交/新上市比 将成为十多年来第二低,仅次于2008年。

预计本月大温地产局指标价会继续同比环比双跌。

年份 成交 新上市 比例

2001 2394 1856 129.0%

2002 2205 1895 116.4%

2003 2434 2301 105.8%

2004 2065 1764 117.1%

2005 2332 1735 134.4%

2006 1686 1524 110.6%

2007 1897 1695 111.9%

2008 924 1550 59.6%

2009 2515 2153 116.8%

2010 1899 1699 111.8%

2011 1658 1629 101.8%

2012 1110 1380 89% (预测)

2012 vs 2011

Sales: 953 vs 1328 (-28%)

vs Nov: 953 vs 1241 (-23%)

Lists: 1215 vs 1375 (-12%)

Ratio: 78% vs 97%

Est Dec Sales: 1110 vs 1658 (-33% YoY, -34% MoM)

Est Dec Lists: 1380 vs 1629 (-15% YoY)

Est Dec Inventory: 13400 vs 12000 (+12% YoY)

Months of Inventory:11.5-12.5 months vs 7.2月 (vs Dec/11)

Greater Vancouver MOI is expected to reach ~12 months by month-end, worse than the 9.3 months of inventory in November 2012. We're heading deeper into Buyer's Market territory.

December sales and Sales/New-Lists Ratio will again be 2nd lowest in the last 10+ years.

REBGV HPI price is expected to fall again this month.

大温地区滞销量在12月底将达到12个月,比上个月(9.3个月) 滞销加剧, 更加深入买方市场

今年12月成交/新上市比 将成为十多年来第二低,仅次于2008年。

预计本月大温地产局指标价会继续同比环比双跌。

年份 成交 新上市 比例

2001 2394 1856 129.0%

2002 2205 1895 116.4%

2003 2434 2301 105.8%

2004 2065 1764 117.1%

2005 2332 1735 134.4%

2006 1686 1524 110.6%

2007 1897 1695 111.9%

2008 924 1550 59.6%

2009 2515 2153 116.8%

2010 1899 1699 111.8%

2011 1658 1629 101.8%

2012 1110 1380 89% (预测)

Thursday 20 December 2012

2012-Q3: BC pop growth 8 year low. Worse inter-provincial outflow. Immigrant Investor -54% YoY

BC 2012-Q3 人口成长率8年来新低。省际净移出加剧。投资移民同比减54%

BC Population Highlights 2012-Q3 刚出炉

官方报告PDF 见此

Investor Class 从去年Q3 的 1149 降至 529 (-54%) - (PDF第6页)

家庭团聚 从去年Q3 的 2636 降至 2263 (-14%)

总BC landing移民: 从去年Q3 的 9882 降至 8476 (-14%)

省际迁移从去年Q3的 -802 恶化至 -2748. - (PDF最后一页左侧)

人口成长率 (Annual growth rate) 不断下降 - (PDF最后一页右侧)

2005Q3: +1.1%

2006Q3: +1.2%

2007Q3: +1.7%

2008Q3: +1.7%

2009Q3: +1.7%

2010Q3: +1.5%

2011Q3: +1.0%

2012Q3: +0.9%

2012-Q3 及历史BC人口变动

(最右侧数据点为 2012-Q3)

source: housing-analysis.blogs...-2012.html

12月19日讯: 移民新政将注重1。年纪轻 2。英文好 3。学历证明

New immigration points system will favour younger workers, language skills

Dec 19, 2012

The government is seeking to make youth and language proficiency a bigger priority for both principal applicants and their spouses. Under the new system, the government will also award more points for Canadian work experience and would-be newcomers will have to have their education credentials assessed before arriving in Canada.

news.nationalpost.com/...ge-skills/

Wednesday 19 December 2012

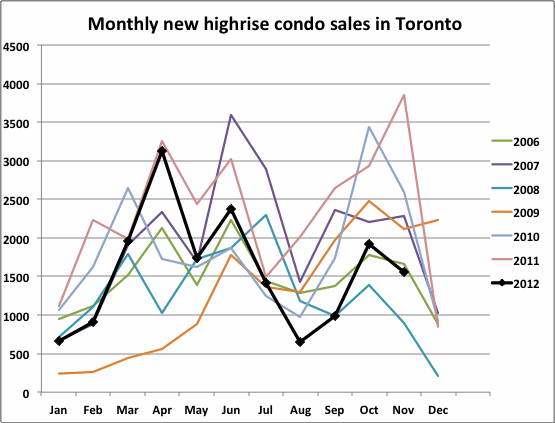

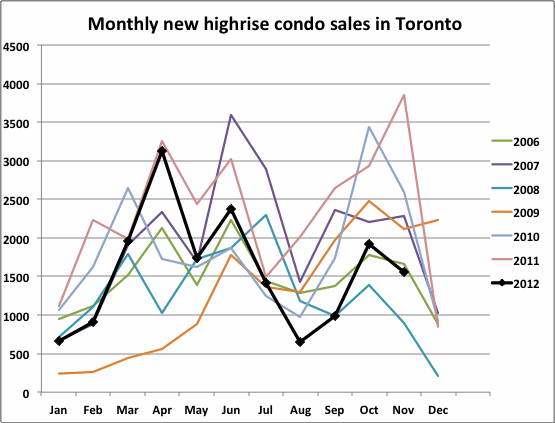

Greater Toronto New Home Sales plummet 60%

大多新公寓 成交量同比:

消息来源

http://stream1.newswire.ca/media/201...C_EN_22072.pdf

http://www.newswire.ca/en/story/1091...new-home-sales

大多新公寓成交量记录

source: Ben Rabidoux www.theeconomicanalyst.com

大多新公寓 剩余房源 - 历史高位

Highrise vs Lowrise

新高层公寓滞销: 13.8个月的滞销房源。 (明显"买方市场")

- 这不包括明后年将完工的楼花 - 房源将更加供过于求

供需完全失去平衡,降价压力加重。

消息来源

http://stream1.newswire.ca/media/201...C_EN_22072.pdf

http://www.newswire.ca/en/story/1091...new-home-sales

大多新公寓成交量记录

source: Ben Rabidoux www.theeconomicanalyst.com

大多新公寓 剩余房源 - 历史高位

Highrise vs Lowrise

新高层公寓滞销: 13.8个月的滞销房源。 (明显"买方市场")

- 这不包括明后年将完工的楼花 - 房源将更加供过于求

供需完全失去平衡,降价压力加重。

IMF warns tighter mortgage rules needed. What'd The F Do?!

IMF 过了一年再次警告加拿大家庭负债继续攀升。 政府应再次缩紧房贷

IMF 在2011年12月警告过: 加拿大房市过热。 政府应考虑采取进一步缩紧房贷措施

GF 在2012年2月发表了政府房贷政策预测

而财长 Flaherty 在 2012年6月20日公布了缩紧房贷政策

但是财长 Flaherty 在 今年10月有说过 "我们 [缩紧房贷] 已做的够多了。我不打算未来再度缩紧房贷"

- 他会怎么做呢 ?

GF: 若财长Flaherty要在2013年再度缩紧房贷,GF认为把首付调高至7.5%是可能的选择。 而财长可能会向2012年一般,等到春季销售期过了再重新评估是否进一步限制房贷。

GF认为财长在2013年进一步作出"打房政策" (增首付,再次减少Re-finance 时可借的比例,再次调低CMHC政府担保房贷的上限, 缩紧 [借贷/收入比例]上限) 的几率为10%-20% (不高)

Translation: GF believes that if Flaherty is to further tighten mortgages in 2013, then increasing down payment to 7.5% (from 5%) is a possible and effective move. Flaherty will likely wait until mid-year to reassess the housing market (which was what he did in 2012).

GF "guesstimates" the chance of further mortgage rule tightening in 2013 to be low but not insignificant. ~10%-20% chance.

Possible changes include DP increase, lower LTV on refinancing, lower caps on debt-service-to-income ratio, and further decrease maximum insurable home price (currently $1M)

Even tighter mortgage rules may be needed: IMF

"Ottawa may have to do more to tame Canadian households' high levels of debt, the International Monetary Fund said on Wednesday.

Ottawa's latest round of tighter mortgage regulations came over summer when it lowered the amortization period to 25 years from 30 years and cut the amount of money consumers could borrow against their home, among other changes.

While the real estate industry has been blaming the changes for the recent slowdown in sales, particularly in Vancouver and Toronto when November sales fell 29 and 16 percent, respectively, the IMF says more may be needed, as the debt-to-income level continues to creep higher."

"However, should the household debt to income ratio continue to rise, additional measures may be needed," the report warns. "Higher down payment requirements (tighter loan-to-value [LTV] limits for first buyers), lower caps on debt-service-to-income ratios, and tighter LTV on refinancing are some of the possible options."

http://www.bnn.ca/News/2012/12/19/Even-tighter-mortgage-rules-may-be-needed-IMF.aspxIMF said the same thing in Dec 2011

“Policy makers should continue to watch developments in the mortgage market closely, the fund said. Lending for homes has slowed, but still is growing at a “robust” pace of almost 7 per cent, the report said.

Finance should be ready to take steps to slow borrowing further if home lending continues to expand excessively, such as larger down-payment requirements for mortgages and demanding lower debt service-to-income ratios, the IMF said.”

BUT Flaherty said in Oct/12 “We’ve done enough. I do not intend to do anymore.”

- What’d the F do?

BC Residential Tenancy Documents (+ translated versions)

要注意的是英文原版租约才有法律效果 - English (legal) tenancy agreement

www.rto.gov.bc.ca/docu.../RTB-1.pdf

简体中文译 租约 (仅供参考,法律上无效) - Simplified Chinese RTB-1 (NOT legal document)

tenants.bc.ca/ckfinder...%20Web.pdf

繁体中文译 租约 (仅供参考,法律上无效) - Traditional Chinese RTB-1 (NOT legal document)

tenants.bc.ca/ckfinder...%20Web.pdf

www.rto.gov.bc.ca/docu.../RTB-1.pdf

简体中文译 租约 (仅供参考,法律上无效) - Simplified Chinese RTB-1 (NOT legal document)

tenants.bc.ca/ckfinder...%20Web.pdf

繁体中文译 租约 (仅供参考,法律上无效) - Traditional Chinese RTB-1 (NOT legal document)

tenants.bc.ca/ckfinder...%20Web.pdf

Condition Inspection Report

http://www.rto.gov.bc.ca/documents/RTB-27.pdf

BC住宅租务法 - 房东和租客指南 (繁体中文版) - Traditional Chinese - Landlord & Tenant Guide

www.rto.gov.bc.ca/docu...tional.pdf

BC住宅租务法 - 房东和租客指南 (繁体中文版) - Traditional Chinese - Landlord & Tenant Guide

www.rto.gov.bc.ca/docu...tional.pdf

Other Forms:

Tuesday 18 December 2012

BMO: Vancouver RE will decline, even if low rates / job growth

BMO 理财部门副总裁兼资深经济学家 Sal Guatieri 在 12月19日发表的 BMO 官方文件中说到

“大温地区房价过于高昂,即使利息持续呆在低位,即使就业率增加,大温房价还是会继续面临更大跌幅。”

...One clear exception is Vancouver, where lofty valuations point to further price declines— even if rates stay low and job growth continues.

http://www.bmonesbittburns.com/econo...ts/dec1912.pdf

“大温地区房价过于高昂,即使利息持续呆在低位,即使就业率增加,大温房价还是会继续面临更大跌幅。”

...One clear exception is Vancouver, where lofty valuations point to further price declines— even if rates stay low and job growth continues.

http://www.bmonesbittburns.com/econo...ts/dec1912.pdf

Saturday 15 December 2012

mid-December Vancouver sales stats

Dec 1-14 Greater Van Sales Stats

2012 vs 2011

Sales: 645 vs 926 (-30%)

vs Nov: 645 vs 828 (-22%)

Lists: 884 vs 1016 (-13%)

Ratio: 73% vs 91%

Est Dec Sales: 1110 vs 1658 (-33% YoY, -34% MoM)

Est Dec Lists: 1250 vs 1629 (-24% YoY)

Est Dec Inventory: 13400 vs 12000 (+12% YoY)

Months of Inventory:11.5-12.5 months vs 7.2月 (vs Dec/11)

Greater Vancouver MOI is expected to reach ~12 months by month-end, worse than the 9.3 months of inventory in November 2012. We're heading deeper into Buyer's Market territory.

December sales and Sales/New-Lists Ratio will again be 2nd lowest in the last 10+ years.

REBGV HPI price is expected to fall again this month.

大温地区滞销量在12月底将达到12个月,比上个月(9.3个月) 滞销加剧, 更加深入买方市场

今年12月成交/新上市比 将成为十多年来第二低,仅次于2008年。

预计本月大温地产局指标价会继续同比环比双跌。

年份 成交 新上市 比例

2001 2394 1856 129.0%

2002 2205 1895 116.4%

2003 2434 2301 105.8%

2004 2065 1764 117.1%

2005 2332 1735 134.4%

2006 1686 1524 110.6%

2007 1897 1695 111.9%

2008 924 1550 59.6%

2009 2515 2153 116.8%

2010 1899 1699 111.8%

2011 1658 1629 101.8%

2012 1110 1250 89% (预测)

2012 vs 2011

Sales: 645 vs 926 (-30%)

vs Nov: 645 vs 828 (-22%)

Lists: 884 vs 1016 (-13%)

Ratio: 73% vs 91%

Est Dec Sales: 1110 vs 1658 (-33% YoY, -34% MoM)

Est Dec Lists: 1250 vs 1629 (-24% YoY)

Est Dec Inventory: 13400 vs 12000 (+12% YoY)

Months of Inventory:11.5-12.5 months vs 7.2月 (vs Dec/11)

Greater Vancouver MOI is expected to reach ~12 months by month-end, worse than the 9.3 months of inventory in November 2012. We're heading deeper into Buyer's Market territory.

December sales and Sales/New-Lists Ratio will again be 2nd lowest in the last 10+ years.

REBGV HPI price is expected to fall again this month.

大温地区滞销量在12月底将达到12个月,比上个月(9.3个月) 滞销加剧, 更加深入买方市场

今年12月成交/新上市比 将成为十多年来第二低,仅次于2008年。

预计本月大温地产局指标价会继续同比环比双跌。

年份 成交 新上市 比例

2001 2394 1856 129.0%

2002 2205 1895 116.4%

2003 2434 2301 105.8%

2004 2065 1764 117.1%

2005 2332 1735 134.4%

2006 1686 1524 110.6%

2007 1897 1695 111.9%

2008 924 1550 59.6%

2009 2515 2153 116.8%

2010 1899 1699 111.8%

2011 1658 1629 101.8%

2012 1110 1250 89% (预测)

Friday 14 December 2012

S&P lowers ratings on six Canadian financial institutions

Globe & Mail

Dec 14, 2012

S&P said Thursday it was downgrading Bank of Nova Scotia, the country’s third-biggest bank, and National Bank of Canada, the sixth-largest lender, by one notch. The agency also lowered its ratings on Central 1 Credit Union, Caisse centrale Desjardins, Home Capital Group Inc. and Laurentian Bank of Canada by one grade.

... as bond-rating agencies take a harder look at the slumping economy, high consumer debt, and low interest rates, which are expected to cause a slowdown in bank profitability in the coming year. Other agencies, such as DBRS and Moody’s have moved to downgrade their ratings of Canadian financial institutions by one notch in recent months.

http://www.theglobeandmail.com/report-on-business/sp-lowers-ratings-on-canadian-financial-institutions/article6351084/

For British Columbians, news that a leading credit rating agency was sounding the alarm on the province’s debt and economic outlook must have come as a shock.

S&P 降级 6个加国银行

两天前BC省债才被Moody's 发出降级警告

正如GF一年前说过,BC省过度依赖房地产的经济,将面临巨大挑战。

省政府的地产交易税收已开始明显缩水。

BC经济面临寒冬。

Dec 14, 2012

S&P said Thursday it was downgrading Bank of Nova Scotia, the country’s third-biggest bank, and National Bank of Canada, the sixth-largest lender, by one notch. The agency also lowered its ratings on Central 1 Credit Union, Caisse centrale Desjardins, Home Capital Group Inc. and Laurentian Bank of Canada by one grade.

... as bond-rating agencies take a harder look at the slumping economy, high consumer debt, and low interest rates, which are expected to cause a slowdown in bank profitability in the coming year. Other agencies, such as DBRS and Moody’s have moved to downgrade their ratings of Canadian financial institutions by one notch in recent months.

http://www.theglobeandmail.com/report-on-business/sp-lowers-ratings-on-canadian-financial-institutions/article6351084/

Harsh reality darkens B.C. premier’s sunny debt forecasts

For British Columbians, news that a leading credit rating agency was sounding the alarm on the province’s debt and economic outlook must have come as a shock.

Last year’s projections in B.C. for natural gas revenues have become irrelevant. Royalties have shrivelled to peanuts in the current economic environment. In the meantime, the housing market has slowed to a crawl. Not only are fewer homes being built, but the sale of existing homes can now safely be described as worse than sluggish.

In a real estate-centric market such as Greater Vancouver, this has a trickle-down effect. The government is seeing significantly less tax money from property transfers and goods and services associated with the real estate market – the sale of furniture and appliances, for example.

The news gets worse when you consider that British Columbians have the highest personal debt levels in the country, thanks in part to the massive mortgages they carry. A drop in house prices of 20 to 30 per cent, which could happen, could spell doom for many people who would no longer have the asset value to pay off their debts.

Not surprisingly, the B.C. government is playing down Wednesday’s announcement by Moody’s Investors Service that its Triple A credit rating is in jeopardy.

S&P 降级 6个加国银行

两天前BC省债才被Moody's 发出降级警告

正如GF一年前说过,BC省过度依赖房地产的经济,将面临巨大挑战。

省政府的地产交易税收已开始明显缩水。

BC经济面临寒冬。

Wednesday 12 December 2012

Richmond realtor James Wong's Nov report

Outspoken Richmond realtor James Wong just released his November report

Key quotes from James Wong this month:

- "Richmond detached homes are expected to suffer the most in price erosion."

- "2013 will be another difficult year for Richmond"

Richmond Stats bits:

Inventory:

- SFH at 12.2 months of inventory (MOI)

- Condos at 9.9 MOI

- Town Houses at 8.2 MOI

Jan 1st, 2012 Total Inventory (all types) in Richmond: 1655

Projected Jan 1st, 2013 Total Inventory in Richmond: 1950 (+18% YoY)

"The absence of home buyers, dampened market sentiment, and tightened lending rules are expected to continue into 2013. The current MOI though better than the past 2 months, will likely be reversed when more new listings hit the market the next few weeks."

"列治文独立屋将面临最严重的跌幅"

"2013年将是列治文房市又一个艰苦的一年"

2012年11月独立屋滞销度为12个月 (明显买方市场)

大于 $1.0M: 16.4个月滞销 (明显买方市场)

大于 $1.5M: 24.4个月滞销 (明显买方市场)

2012年初列治文总房源为1655。而列治文2013年初房源将接近1950, 等于+18% 的增幅。

2013年,买方不足,信心缺乏,房贷还紧。 列治文2013房市将继续深入买方市场,房价将继续下调。

Key quotes from James Wong this month:

- "Richmond detached homes are expected to suffer the most in price erosion."

- "2013 will be another difficult year for Richmond"

Richmond Stats bits:

Inventory:

- SFH at 12.2 months of inventory (MOI)

- SFH > $1.0M: 16.4 MOI

- SFH > $1.5M: 24.4 MOI

- Condos at 9.9 MOI

- Town Houses at 8.2 MOI

Jan 1st, 2012 Total Inventory (all types) in Richmond: 1655

Projected Jan 1st, 2013 Total Inventory in Richmond: 1950 (+18% YoY)

"The absence of home buyers, dampened market sentiment, and tightened lending rules are expected to continue into 2013. The current MOI though better than the past 2 months, will likely be reversed when more new listings hit the market the next few weeks."

"There are no signs of the Government changing or relaxing the current lending directives to Canadian Banks. Richmond’s market for 2013 is expected to have persistently high number of homes for sale and below average buying interest."

列治文11月数据 (数据来源: 地产经纪 James Wong)"列治文独立屋将面临最严重的跌幅"

"2013年将是列治文房市又一个艰苦的一年"

2012年11月独立屋滞销度为12个月 (明显买方市场)

大于 $1.0M: 16.4个月滞销 (明显买方市场)

大于 $1.5M: 24.4个月滞销 (明显买方市场)

2012年初列治文总房源为1655。而列治文2013年初房源将接近1950, 等于+18% 的增幅。

2013年,买方不足,信心缺乏,房贷还紧。 列治文2013房市将继续深入买方市场,房价将继续下调。

Monday 10 December 2012

Why don't realtors swoop in to snatch the 'bargains' themselves now?

Forum member 'helen qian' asked today: "Why don't realtors swoop in to snatch the 'bargains' today themselves?"

GF gives her 3 reasons:

1. The smart ones already cashed out. They know that we've just past the peak, but still a long way from bottom.

2. The others aren't so lucky, their RE investments are still tied up in this illiquid market. The ones that bought within the last 1-2 years basically will all lose money if they sell today.

3. Since mid 2011, Greater Vancouver sales witness sustained decline. 2012 annual sales volume is expected to end up close to 2008. Also, total number of realtors in Greater Vancouver increased from 9500 (Nov 2008) to 11000 (Nov 2012), a 16% gain. As Chinese proverb goes, "more monks, less congee." In addition, there are more realtors/RE companies offering fee rebates and discounts, including the growing "1% realty", "2% realty", and realtors that offer to list on MLS for a couple hundred dollars. Growing competition in this down-market has been eating into realtors' commission-based income.

Here's a graph from Jesse's Housing Analysis Blog charting year-to-date REBGV sales:

1. 精明的,知道现在才刚过巅峰,离底还..有一阵子

2. 其它的,原本的投资房,楼花等等还被套着,愈套愈深。一两年内买的现在脱手基本上都亏本。

3. 从2011年中,大温成交量已大不如前。 2012年全年总销售量看来将与2008年相当。而现在大温经纪数量(11,000)又比2008年 (9,500)增加了16%.

僧多粥少,再加上愈来愈多的廉价经纪公司(1%, 2%,或是几百刀挂MLS自卖)竞争,造成地产经纪收入大不如前。

Source: Housing Analysis Blog

GF gives her 3 reasons:

1. The smart ones already cashed out. They know that we've just past the peak, but still a long way from bottom.

2. The others aren't so lucky, their RE investments are still tied up in this illiquid market. The ones that bought within the last 1-2 years basically will all lose money if they sell today.

3. Since mid 2011, Greater Vancouver sales witness sustained decline. 2012 annual sales volume is expected to end up close to 2008. Also, total number of realtors in Greater Vancouver increased from 9500 (Nov 2008) to 11000 (Nov 2012), a 16% gain. As Chinese proverb goes, "more monks, less congee." In addition, there are more realtors/RE companies offering fee rebates and discounts, including the growing "1% realty", "2% realty", and realtors that offer to list on MLS for a couple hundred dollars. Growing competition in this down-market has been eating into realtors' commission-based income.

Here's a graph from Jesse's Housing Analysis Blog charting year-to-date REBGV sales:

1. 精明的,知道现在才刚过巅峰,离底还..有一阵子

2. 其它的,原本的投资房,楼花等等还被套着,愈套愈深。一两年内买的现在脱手基本上都亏本。

3. 从2011年中,大温成交量已大不如前。 2012年全年总销售量看来将与2008年相当。而现在大温经纪数量(11,000)又比2008年 (9,500)增加了16%.

僧多粥少,再加上愈来愈多的廉价经纪公司(1%, 2%,或是几百刀挂MLS自卖)竞争,造成地产经纪收入大不如前。

Source: Housing Analysis Blog

Friday 7 December 2012

December stats so far (REBGV)

Dec 1-7 Stats

2012 vs 2011

Sales: 343 vs 494 (-31%)

vs Nov/12: 343 vs 404 (-15%)

New Lists: 508 vs 595 (-15%)

S/L Ratio: 67.5% vs 83.0%

Est month end sales: 1160 vs 1658 (-30% YoY, MoM)

Est month end lists: 1300 vs 1629 (-20% YoY)

Est month end inventory: 13500 vs 12000 (+ 12-13% YoY)

Est month end MOI: 11-12 months vs 7.2 (2011)

Greater Vancouver months of inventory is projected to reach 11-12 months by year end, worse than November's MOI (9.3 months), bringing Vancouver deeper into buyer's market territory.

Sales and S/L ratio will both rank as 2nd worst in past 11+ years.

HPI price is expected to continue its decline, both MoM and YoY.

大温地区滞销量在12月底将达到11-12个月,比上个月(9.3个月) 滞销加剧, 更加深入买方市场

今年12月成交/新上市比 将成为十多年来第二低,仅次于2008年。

预计本月大温地产局指标价会继续同比环比双跌。

Year 成交 新上市 Ratio

2001 2394 1856 129.0%

2002 2205 1895 116.4%

2003 2434 2301 105.8%

2004 2065 1764 117.1%

2005 2332 1735 134.4%

2006 1686 1524 110.6%

2007 1897 1695 111.9%

2008 924 1550 59.6%

2009 2515 2153 116.8%

2010 1899 1699 111.8%

2011 1658 1629 101.8%

2012 1160 1300 89% (Est)

* Stat source: award winning realtor Paul Boenisch

2012 vs 2011

Sales: 343 vs 494 (-31%)

vs Nov/12: 343 vs 404 (-15%)

New Lists: 508 vs 595 (-15%)

S/L Ratio: 67.5% vs 83.0%

Est month end sales: 1160 vs 1658 (-30% YoY, MoM)

Est month end lists: 1300 vs 1629 (-20% YoY)

Est month end inventory: 13500 vs 12000 (+ 12-13% YoY)

Est month end MOI: 11-12 months vs 7.2 (2011)

Greater Vancouver months of inventory is projected to reach 11-12 months by year end, worse than November's MOI (9.3 months), bringing Vancouver deeper into buyer's market territory.

Sales and S/L ratio will both rank as 2nd worst in past 11+ years.

HPI price is expected to continue its decline, both MoM and YoY.

大温地区滞销量在12月底将达到11-12个月,比上个月(9.3个月) 滞销加剧, 更加深入买方市场

今年12月成交/新上市比 将成为十多年来第二低,仅次于2008年。

预计本月大温地产局指标价会继续同比环比双跌。

Year 成交 新上市 Ratio

2001 2394 1856 129.0%

2002 2205 1895 116.4%

2003 2434 2301 105.8%

2004 2065 1764 117.1%

2005 2332 1735 134.4%

2006 1686 1524 110.6%

2007 1897 1695 111.9%

2008 924 1550 59.6%

2009 2515 2153 116.8%

2010 1899 1699 111.8%

2011 1658 1629 101.8%

2012 1160 1300 89% (Est)

* Stat source: award winning realtor Paul Boenisch

Vancouver Unemployment Rate vs Canada

大温失业率 Greater Vancouver Unemployment Rate (vs Canada):

Apr 2012: 6.2% (7.3% Canada)

May 2012: 6.4% (7.3% Canada)

Jun 2012: 6.4% (7.2% Canada)

Jul 2012: 6.8% (7.3% Canada)

Aug 2012: 6.8% (7.3% Canada)

Sep 2012: 7.0% (7.4% Canada)

Oct 2012: 7.2% (7.4% Canada)

Nov 2012: 7.2% (7.2% Canada)

Apr 2012: 6.2% (7.3% Canada)

May 2012: 6.4% (7.3% Canada)

Jun 2012: 6.4% (7.2% Canada)

Jul 2012: 6.8% (7.3% Canada)

Aug 2012: 6.8% (7.3% Canada)

Sep 2012: 7.0% (7.4% Canada)

Oct 2012: 7.2% (7.4% Canada)

Nov 2012: 7.2% (7.2% Canada)

Recent price reductions in W Richmond

Price Drop 降幅 - New Price 新价

6351 Bernard $62,000 $1,218,000

4900 Westminster $49,500 $757,500

4491 Tiffin $29,000 $799,000

9551 Chapmond $31,000 $868,000

8740 Bairdmore $90,000 $1,288,000

8580 Citadel $19,800 $699,000

4740 Princeton $78,000 $1,299,000

9320 Bashuk $74,200 $1,175,800

8620 Cadogan Rd. $52,000 $1,996,000

4108 Garry St. $80,000 $1,118,000

35-11771 Kingfisher $35,000 $398,000

5191 Merganser $27,000 $888,000

10200 Bamberton Dr. $109,000 $1,190,000

6351 Bernard $62,000 $1,218,000

4900 Westminster $49,500 $757,500

4491 Tiffin $29,000 $799,000

9551 Chapmond $31,000 $868,000

8740 Bairdmore $90,000 $1,288,000

8580 Citadel $19,800 $699,000

4740 Princeton $78,000 $1,299,000

9320 Bashuk $74,200 $1,175,800

8620 Cadogan Rd. $52,000 $1,996,000

4108 Garry St. $80,000 $1,118,000

35-11771 Kingfisher $35,000 $398,000

5191 Merganser $27,000 $888,000

10200 Bamberton Dr. $109,000 $1,190,000

Thursday 6 December 2012

G&M: Bank of Canada issues harsh warning on condo market

GF: The self-reinforcing "Financial Decelerator" risk that was discussed here 3 days ago - now BoC is expressing similar worries.

Published

Published

Bank of Canada warns on condos

The Bank of Canada issued a harsh warning today about overbuilding of high-rise housing, notably condos.

The Bank of Canada issued a harsh warning today about overbuilding of high-rise housing, notably condos.

“In the current context, a specific concern is that the total number of housing units under construction has been increasing and is now well above its historical average relative to the population,” the central bank said in its financial system review.

Today, as The Globe and Mail’s Barrie McKenna reports, the Bank of Canada again voiced in concern over the vulnerability of consumers to “economic shocks,” such as a housing bust or a spike in unemployment.

“If the upcoming supply of units is not absorbed by demand as they are completed over the next 18 to 36 months, the supply-demand imbalance will become more pronounced, increasing the risk of a sudden correction in prices”

That, in turn, could pressure house prices in general, which itself would spread through the broader economy.

“This would likely lead to a decline in housing activity, adversely affecting household incomes

and employment, as well as confidence and household net worth, which would in turn reduce household spending,” the Bank of Canada said.

“As the declines in incomes and employment impair households’ ability to service their debt, loan losses at financial institutions would likely rise. These effects may be amplified by tighter borrowing conditions as lenders come under increased stress. These interrelated factors would further dampen economic activity and add to the strains on household and bank balance sheets. They may also cause house prices to fall below the level required to correct any initial overvaluation.”

From my post in comment section on Dec 3:

I wanted to add in Consumer confidence, which I suppose is tightly associated with most of the above factors (income/unemployment/debt level/macro factors). While searching for articles linking consumer confidence with housing price, this article popped up high on google's search result list:Self-reinforcing effects between housing prices and credit - Evidence from Norway

Mostly over my head, even more so at 2am, but managed to read the conclusion. Looks like it's describing the "self-reinforcing" cumulative effect of credit and housing prices (formation of bubble), and how consumer confidence is a major variable determining short-term home price movements.

That led me to wonder, if multiple negative factors (credit tightening, income stagnation, unemployment, high debt, poor national/global econ outlook) coexist, perhaps a self-reinforcing cycle of RE-depreciation and further-decreased credit availability will emerge in Canada - unless the government steps in to break the negative cycle (not likely in near future as reducing household debt level seems to be Flaherty's main goal)..

2013 might very well be the year for the self-reinforcing "financial decelerator" to kick in, a.k.a "bursting of a bubble"..

Subscribe to:

Posts (Atom)